1.1.6 Russia’s food retail market

Key highlights

Competitive environment

In both the proximity and supermarket segments, X5 is the #1 player with Pyaterochka and Perekrestok stores, and we have established a solid foothold in hypermarkets with Karusel.

- Strong brand

- Loyalty programme

- Broad assortment

- Focus on fresh

- Strong brand in capitals

- Service level, NPS

- Focus on fresh

- Online service

- New CVP

- Good locations

- Hard discounters

- Gas stations

- Dollar stores

Note: Charts above are based on market share by total turnover

After the successful transformation of our business into three largely independent food retail formats, each able to grow and develop based on its unique CVP, X5 Retail Group has consistently increased its ranking among its Russian and global peers.

Note: revenue growth y-o-y

| # | Company name | % market share 2018 | % market share 2017 |

|---|---|---|---|

| 1 | Х5 | 10.7 | 9.5 |

| 2 | Magnit | 7.7 | 7.5 |

| 3 | Lenta | 2.8 | 2.5 |

| 4 | SPS Holding (Red&White) | 2.4 | 1.8 |

| 5 | Dixy | 2.1 | 2.1 |

| 6 | Auchan | 1.9 | 2.2 |

| 7 | Metro | 1.3 | 1.4 |

| 8 | O‘Key | 1.1 | 1.2 |

| 9 | Monetka | 0.6 | 0.6 |

| 10 | Globus | 0.6 | 0.6 |

| Total Top 10 | 31.2 | 29.4 |

Source: Infoline

As the Russian food retail market continues to expand, we aim to outgrow the market and our top-10 peers, while at the same time pursuing smart, more targeted growth to ensure the quality and sustainability of every new store that we open and subsequent return on our investments.

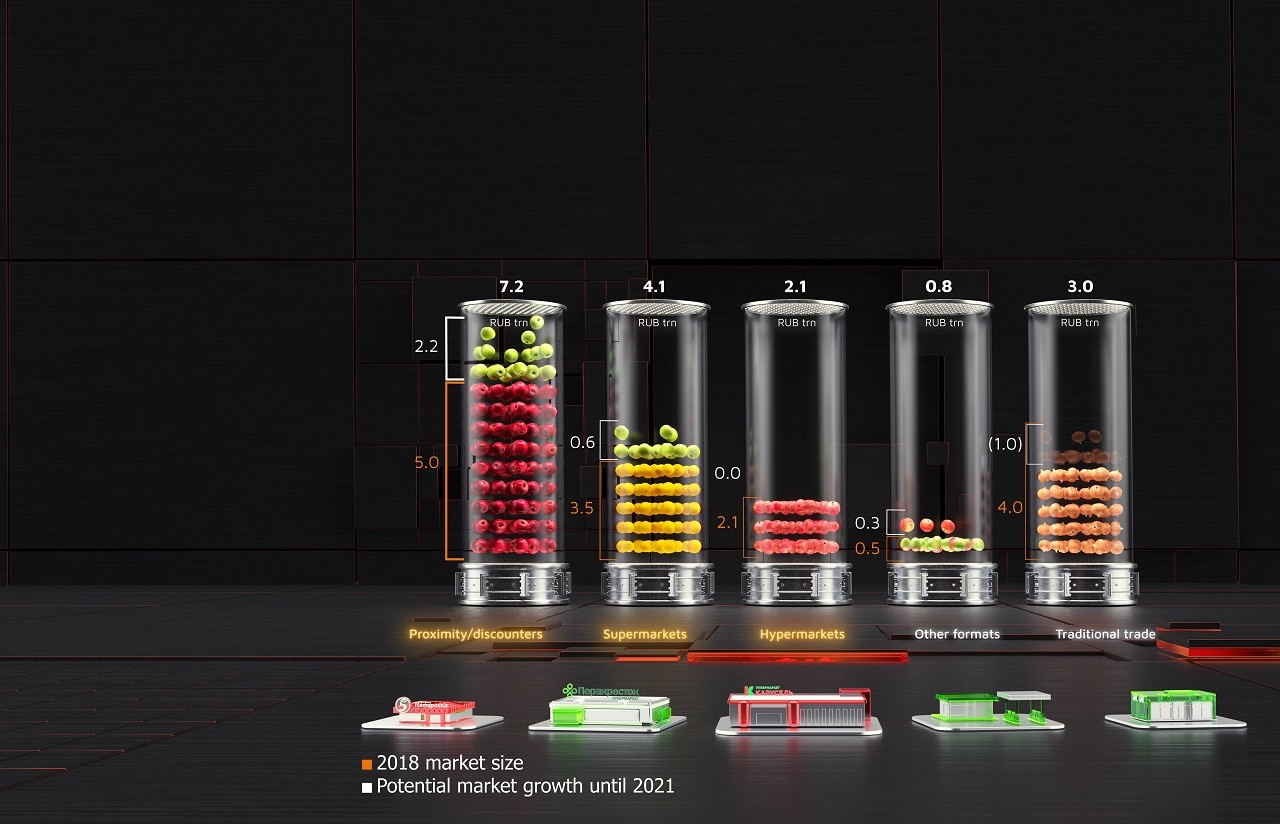

Russia’s largest food retail segments

Total market size:

2018: RUB 15.0 trn

2021F: RUB 17.2 trn

The share of modern formats in the Russian food retail market has grown significantly in recent years and currently stands at 73%. However, this level still lags behind several developed markets like North America, Western Europe and Australia, where modern formats represent 87%, 81% and 81% of the food retail market, respectively. We believe that the expansion of modern retail formats is one of several drivers of growth in the years ahead.

Modern formats represented just 64% of the food retail market in 2015, and increased to 73% in 2018. While this represents substantial growth, penetration of modern retail formats is expected to increase further in the years ahead, with a forecast 82% share of the total Russian food retail market expected to be reached by 2021.

In addition to growth driven by the further expansion of modern retail formats, we see significant potential for further growth from market consolidation. The Russian food retail sector remains highly fragmented, with the top five players accounting for around 26% of the market. This is two to three times lower than in developed markets such as Germany, the Czech Republic, the UK, France and Poland. We view this as an additional opportunity for expansion. Despite a slowdown in market growth, larger and more efficient players should continue to grow thanks to the natural replacement of smaller and less efficient players. X5 and other retailers with a nationwide reach and the ability to leverage economies of scale to drive efficiency will be the primary beneficiaries of this change.

Russian food retail market trends

Increasing competition

After years of rapid growth, the Russian food retail market has experienced the emergence of new players, which has forced market leaders to constantly evolve and adjust their business models in order to stay ahead. New players have emerged to address changing consumer needs, as existing players were too big or too focused on growth to quickly respond to emerging trends.

We are addressing these changes by evolving our own business, with an emphasis on innovation, omnichannel service, operational excellence and constantly adapting the CVPs of our formats to the needs of our customers.

Online delivery

Consumers are becoming more time-sensitive, and online food shopping, including the ready-to-eat segment, is starting to replace regular grocery shopping trips, especially in hypermarkets. Food delivery from restaurants is a growing sector that is often competing with dining-out options.

In response to these trends, we launched the Perekrestok Online service in 2017 in Moscow and expanded it to St Petersburg in 2018. This service has enjoyed very high NPS levels from its users, and it has grown rapidly, with the total number of orders exceeding 408 thousand in 2018.

Changing consumer behaviour

Consumer behaviour is also rapidly changing. Despite the continued focus on rational consumption and spending cuts, consumer expectations are rising with regard to product quality and customer experience.

This means that a more personalised approach to each customer is becoming increasingly valuable. To address this, we are developing our omnichannel business, and each of our formats offers a loyalty programme, with personal offers being refined on an ongoing basis.

Increasing popularity of healthy diets

Trading down has become an important trend for Russian consumers in the face of negative or slow economic growth. At the same time, expectations have shifted with regard to the quality of goods, and fresh fruits and vegetables have become increasingly important to our customers. Demand for high-quality ready-to-eat meals has also grown significantly. We are responding to these changes by adapting the assortment we offer in stores and by improving our own capacity to efficiently handle fresh and ultra-fresh goods in order to ensure consistent high quality.

Aging population

Russia’s population is not growing, and the share of groups that receive state support in some form is increasing.

In order to address this challenge, we aim to offer products at reasonable prices for lower-income groups. For example, we offer pensioners additional discounts during non-peak opening hours.

Emergence of non-traditional players

New players that do not rely on traditional retail approaches are entering the market. They are able to challenge and disrupt the status quo and are starting to transform the way we do business. Existing retailers must evolve.

We have already begun to adapt our business model to new trends by launching omnichannel projects across all three formats and maintaining a solid pipeline of pilot projects to introduce innovative new ideas to our business.

Development of specialised retailers

The past two years have seen consumer preferences shift towards assortments that offer unique and local goods, with healthy, ready-to-eat and ready-to-cook options becoming more popular. This trend is especially visible in Moscow.

Throughout 2018, we worked to adapt our assortment and new SKUs in Moscow stores across all formats. In order to improve the Perekrestok CVP and to expand the assortment with unique products, we decided to open our own kitchen factory. This modern production facility, which will produce ultra-fresh ready-to-eat products for delivery to our stores, is scheduled to launch in H1 2019.

Economic and consumer trends

Russia’s economy remained on a course of gradual recovery throughout 2018. The main trends that influenced our performance during the year were:

- GDP growth in 2018 reached 2.3%, according to initial estimates

- Weak real disposable income (-0.3% for the year), which still shows no trend towards sustainable recovery, despite steady growth in real wages

- Small incremental growth in food retail trade of 1.7% backed by a cautious recovery in consumer confidence and a moderate decrease in the trend of trading down

- The gradual transition of food inflation from a slowdown in H1 2018 to acceleration in H2 2018: food CPI reached 4.7% year-on-year in December 2018, up from 0.5% in July.

- Unemployment remained low and reached 4.7% in Q4 2018

In 2019, we expect food consumption to continue to recover, despite challenging economic conditions:

- Despite the VAT rate hike from 18% to 20%, economic growth in 2019 is expected to remain positive

- The consensus within the analyst community is that inflation will accelerate in 2019 on the back of the VAT rate hike, FX dynamics, smaller 2018 grain harvest and global macro-factors

- We believe that real food retail trade will continue its moderate recovery in 2019, supported by favourable labour market conditions (wage growth, low unemployment), but balanced by low and real disposable income dynamics and uncertain economic growth outlook

- Consumer expectations should also resume recovery. Trading down as a trend is moderating but remains high relative to pre-crisis levels

| 2018 | 2017 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Russian macroeconomic indicators, year-on-year comparison, % | Q1 | Q2 | Q3 | Q4 | FY | Q1 | Q2 | Q3 | Q4 | FY |

| Real GDP | 1.8 | 2.5 | 2.2 | 2.5 | 2.3 | 0.6 | 2.5 | 2.2 | 0.9 | 1.6 |

| RUB/USD exchange rate, weighted average for the period | 56.9 | 61.8 | 65.5 | 66.5 | 62.7 | 58.8 | 57.1 | 59.0 | 58.4 | 58.4 |

| CPI | 2.3 | 2.4 | 3.0 | 3.9 | 2.9 | 4.6 | 4.2 | 3.4 | 2.6 | 3.7 |

| Food inflation | 1.0 | 0.4 | 1.6 | 3.6 | 1.7 | 3.8 | 4.1 | 2.8 | 1.3 | 3.0 |

| Real wage growth | 10.2 | 7.6 | 6.3 | 3.8 | 6.8 | 1.8 | 3.4 | 3.1 | 5.9 | 2.9 |

| Real income growth | 0.3 | 1.3 | (1.6) | (1.1) | (0.3) | 0.3 | (2.2) | (1.3) | (1.1) | (1.2) |

| Unemployment rate | 5.1 | 4.8 | 4.6 | 4.7 | 4.8 | 5.5 | 5.2 | 5.0 | 5.1 | 5.2 |

| Retail turnover | 4.6 | 5.5 | 6.0 | 6.9 | 5.8 | 3.9 | 5.6 | 5.6 | 5.8 | 5.3 |

| Food retail turnover | 3.5 | 4.0 | 3.1 | 5.3 | 4.0 | 3.1 | 5.1 | 6.0 | 5.6 | 5.0 |

Source: Rosstat, Ministry of Economic Development

Macroeconomic volatility and increasing competition make cost optimisation a key to success. We are committed to improving operational efficiency and cost controls.

- The key factors affecting our market in 2018 were a record decline in food CPI (to 1.7% year-on-year annual average), which impacted nominal retail trade growth rates, volatile real disposable income dynamics, and a cautious recovery in consumption (which halted in the second half of the year)

- The food retail market increased by 1.7% in real terms and by 4.0% year-on-year in nominal terms to RUB 15 trillion in 2018

- On the back of economic volatility, consumers remain cautious, rational and highly sensitive to prices. Using our scale and market positioning, we offer competitive prices in our stores and support consumers additionally via promo. To maintain our ability to support our consumers, we are increasing our focus on operational efficiency and cost control. Our operational improvements in 2018 include shrinkage reduction, optimisation of our lease portfolio and rental rates, reduction of other store costs, Corporate Centre costs and the cost of debt. We significantly improved purchasing terms and will keep working on optimising every cost item

Legislative changes

| Law | Key changes | Date of entry into force | ||

|---|---|---|---|---|

| Change of the procedure for the submission of veterinary documents | As of 1 July 2018, the entire document flow for products of animal origin must be carried out through the Mercury state information system for the registration of electronic veterinary certificates. For more information, please see Federal Law No 243-FZ of 13 July 2015 (as amended on 28 December 2017) | 29 December 2017 | ||

| Law banning the return of unsold goods to suppliers | According to the new law, retailers may not return to suppliers any unsold goods with a shelf life of up to 30 days. For more information, please refer to Federal Law No 446-FZ of 28 November 2018 | 9 December 2018 | ||

| VAT rate increase | The VAT rate increase to 20% applies only to those goods previously taxed at 18%. The VAT rate on goods, previously taxed at 0% or 10% on socially important goods, including a number of groceries (bread, dairy, corn, meat, fish, oil, butter etc.) and children’s goods, remain unchanged. For more information, please refer to Federal Law No 303-FZ of 3 August 2018 | 1 January 2019 | ||

| Mandatory digital labelling for certain products | Mandatory digital labelling of cigarettes will be introduced in Russia from 1 March 2019. A digital data matrix code, which resembles a QR code, must be printed on every pack of cigarettes. It will contain information about the manufacturer and route of the item from factory to store. A list of goods that must add identifying markers to their labels in order to reduce circulation of counterfeit products was approved in 2018. These goods include:

For more information, please refer to the amendments to Federal Law No 15-FZ of 23 February 2013 | 1 January 2019 | ||

| Conducting control purchases to monitor protection of consumer rights and compliance with sanitary and epidemiological regulations | In the course of monitoring consumer rights protection and ensuring sanitation and disease prevention, oversight (supervisory) bodies are allowed to conduct control purchases of goods.

For more information, please refer to Federal Law No 81-FZ of 18 April 2018 | 29 April 2019 | ||

| Introduction of brand-based records on alcohol products | The use of brand-based records makes it possible to track every bottle of alcohol from the moment of production until its sale to the end consumer by using a two-dimensional barcode with EGAIS identifier contained on excise stamps (to mark imported alcohol) or on special federal stamps (to mark alcohol produced in Russia). For more information, please refer to Federal Law No 433-FZ of 28 December 2017 | 1 July 2019 | ||

| Positioning of dairy products on shelves | Dairy, dairy composite and lactiferous products must be placed in selling areas, or at any points of sale, separately from other products. They must be accompanied with the inscription “Products free from milk fat substitute”. For more information, please refer to Decree No 50 of the Government of the Russian Federation of 28 January 2019 | 1 July 2019 |