Karusel

hypermarkets

Karusel hypermarkets

Karusel worked hard to roll out its new CVP in 2018, with eight hypermarkets refurbished under the new concept and a renewed assortment that meets the needs of modern shoppers, who are increasingly interested in a convenient shopping experience, including in-store entertainment. While making our value proposition more attractive to customers, we have also succeeded in increasing sales densities and have focused on efficiency with new staffing structures, better quality control and standardised processes across all hypermarkets we operate.

Karusel aims to reach modern consumers with a rational approach to shopping: they are well-informed, want to get the most out of each trip, with a wide range of goods and competitive prices to stock up for a week or more. Karusel hypermarkets are evolving to meet our customers’ needs and broaden their appeal to new groups of consumers. Our focus on sales densities and increasing customer loyalty means that we will maintain a cautious approach to new openings.

Karusel worked hard to roll out its new CVP in 2018, with eight hypermarkets refurbished under the new concept and a renewed assortment that meets the needs of modern shoppers, who are increasingly interested in a convenient shopping experience, including in-store entertainment. While making our value proposition more attractive to customers, we have also succeeded in increasing sales densities and have focused on efficiency with new staffing structures, better quality control and standardised processes across all hypermarkets we operate.

Karusel aims to reach modern consumers with a rational approach to shopping: they are well-informed, want to get the most out of each trip, with a wide range of goods and competitive prices to stock up for a week or more. Karusel hypermarkets are evolving to meet our customers’ needs and broaden their appeal to new groups of consumers. Our focus on sales densities and increasing customer loyalty means that we will maintain a cautious approach to new openings.

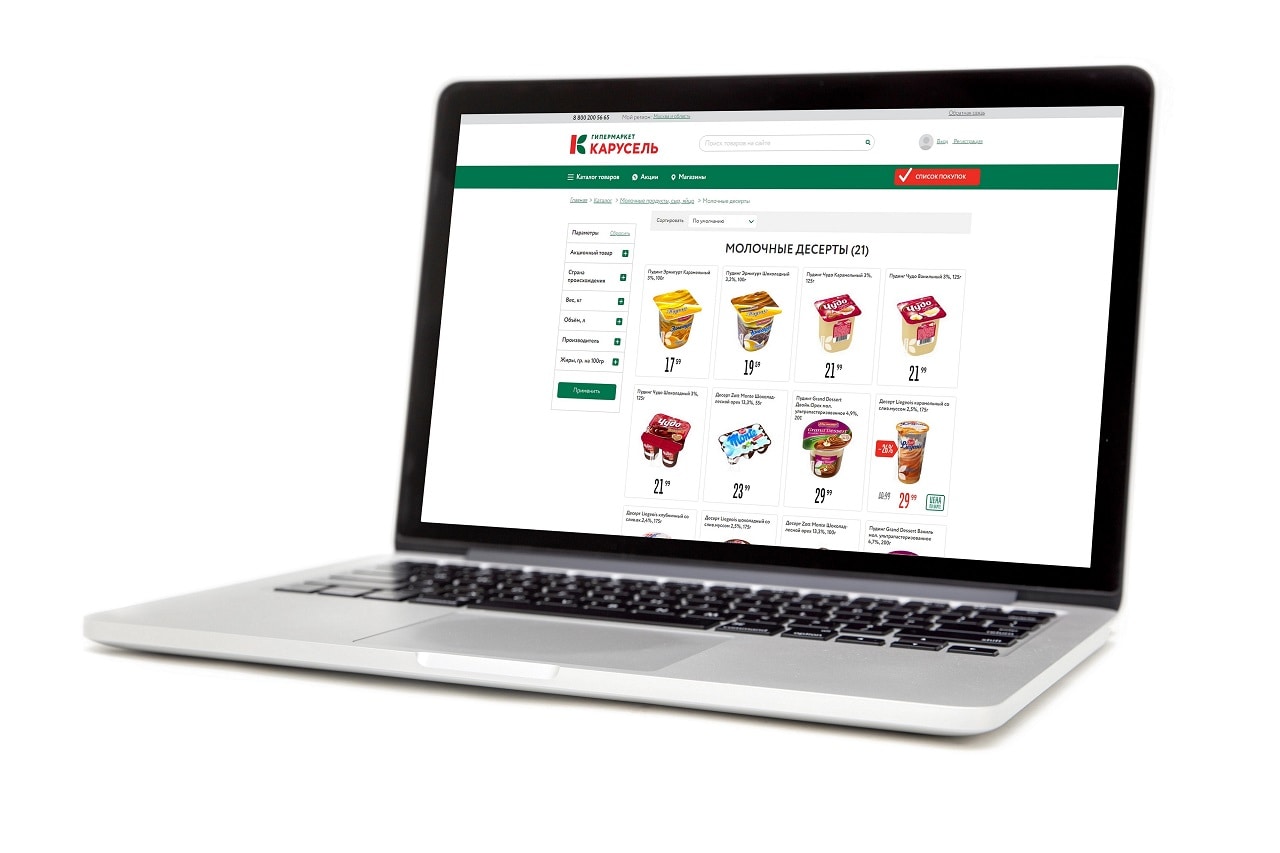

Karusel hypermarkets aim to offer customers a unique and comfortable shopping experience, with an updated brand concept that includes in-store dining, a wider selection of healthy foods and electronic customer communications. As we roll out this model, we continue to innovate and adapt to customer needs, with omnichannel offerings like convenient click-and-collect services, as well as a successful loyalty programme that is highly popular among our customers.

Karusel hypermarkets offer an assortment of 22,000 to 30,000 SKUs of food and non-food items, with an average selling space of 4,064 square metres.

2018 performance highlights

94

2018 strategic highlights

| 2018 | 2017 | 2016 | 2015 | 2014 | |

|---|---|---|---|---|---|

| Number of stores, eop | 94 | 93 | 91 | 90 | 82 |

| Selling space ’000 m2, eop | 382 | 385 | 387 | 390 | 359 |

| Net retail sales, RUB bln | 91 | 89 | 84 | 77 | 69 |

| Customer visits, mln | 132 | 135 | 134 | 129 | 123 |

Strategic Priorities

| Our priorities | What we are doing | What we plan to do |

|---|---|---|

| Continue rollout of new branding and CVP |

|

|

| Develop private label and own production |

| |

| Focus on efficiency in management of people and processes |

| |

| Develop programmes to enhance customer loyalty |

| |

| Expand omnichannel model and digital innovations |

|

Further adaptation of CVP

We began to roll out our new CVP in 2018, with updated branding. Our goal is for our customers to associate our hypermarkets with favourable pricing, honesty and transparency. One area of focus in 2018 was on optimisation of our assortment: as Russian consumers become more and more concerned about the quality and healthiness of their food, we are aiming to provide them with new assortments of healthy foods and unique goods for discerning buyers. We have also worked to make the in-store experience more convenient and comfortable, with simpler internal navigation and more modern visualisations.

We are considering options to improve space utilisation and increase traffic by inviting partners to our hypermarkets.

We are also testing the “large supermarket” format. We currently have two Karusel stores being managed by the Perekrestok team, and we plan to transfer three more stores over to Perekrestok this year.

Private label.

Tailored to customer needs

Our private-label brands are an opportunity to support Karusel’s price perception by offering customers quality goods at lower prices. Our current private-label offering reached 4% of Karusel’s revenue in 2018, and we plan to expand this to as high as 10% by 2020. With a number of private-label brands already on shelves, including our three key cross-category offerings (Krugliy God, Umnoye Resheniye and BeHome), we plan to launch a new non-food line under the Uniline brand in 2019.

In further development of our private labels, one of the key areas we will focus on is introducing unique features that will differentiate our assortment from other brands.

| Cross category – First price |  |

| Cross category – Medium price |  |

| Separate categories – Medium price |  |

Own production and in-store catering

Our own production offering is a key part of Karusel’s updated CVP. We have completely renewed the assortment for our own production, with a more modern selection, more healthy offerings and a wider array of food to go. At the same time, we have focused on optimising the staffing structure and bringing down production costs in order to achieve more sustainable margins.

Our aim is to develop a full-scale food service offering in-store, with pizzas, a cafeteria or restaurant available to customers without leaving the premises. In order to further optimise costs, Karusel plans to centralise its own production for certain regions. Our target is to increase the share of our own production in revenue by 1.0%-1.5% by 2020.

Operational efficiency

Our top priorities for increasing operational efficiency are in the areas of personnel, in-store processes and shrinkage.

We have already launched an HR brand project, as well as a learning and development programme for high-potential employees. Going forward, we aim to introduce initiatives that will improve staff engagement, to refine the incentivisation system and offer better working conditions.

Our in-store efficiency efforts to date have focused on standardisation of business processes across all hypermarkets, optimising staff structures and introducing schedules for regular maintenance and upgrades for equipment and engineering systems. In the years ahead, we will focus on further optimisation and productivity enhancements that leverage IT tools, and we will continue to close inefficient stores.

Shrinkage is currently being addressed with the monitoring of acceptance of goods and cashier operations, as well as optimisation of business processes and improvements to quality control checks at DCs. We aim to further develop our quality control practices, including the introduction of trust-based acceptance at DCs and further development of our direct supplier base for fruits and vegetables.

Loyalty Programme

Karusel’s loyalty programme, which was relaunched in 2015, continues to develop in line with our Group-wide push to leverage data analytics to improve performance. The programme currently enjoys the highest level of penetration in traffic and sales among all of X5’s formats.

Karusel’s loyalty card holders receive personalised offerings and promotions based on their preferences and shopping behaviour. We have also updated the My Karusel mobile app for loyalty programme members, with a new user interface design and the addition of promo banners. Future updates will include an online catalogue to better inform customers about what they will find in our stores, as well as some interactive features.

- Active cards as of 31 December 2018: 2.9 million (as of 31 December 2017: 2.4 million)

- Share of net retail sales for loyalty cards in December 2018: 94% (2017: 80%)

- Penetration of loyalty programme in traffic in December 2018: 81% (2017: 63%)

Omnichannel and digital innovations

In keeping with our move towards digital innovations, we have moved all communications with customers to electronic formats, from email to text messages and our own website and mobile app. We are also digitising in-store processes by setting up distance modules for employees.

As we continue to develop omnichannel sales, we have expanded our cooperation with delivery aggregators like iGooods (Moscow, St Petersburg and Kazan). We aim to expand to new cities in the years ahead. Around 14,000 SKUs are currently available to our hypermarket customers through aggregators.

To further develop our omnichannel sales, we aim to launch a click-and-collect service in 2019. We believe that the click-and-collect model is right for Karusel because most of our stores are located in shopping centres within city limits, and customers frequently visit Karusel as one stop on their shopping trip. Click-and-collect is the perfect way for these shoppers to save time while also being able to achieve their personal shopping missions.