Pyaterochka

proximity stores

Pyaterochka proximity stores

Pyaterochka has reached a crossroads in its development, and the time has come to focus on strengthening the core business while also laying the foundations for new types of growth. In previous years, Pyaterochka focused on its record-setting pace of new store openings. We have already started to decelerate openings in order to focus more on smart expansion and improving investment returns. Going forward, Pyaterochka aims to find new sources of growth on the basis of our existing stores by further adapting its assortment to the changing needs of our customers.

In the years ahead we will continue to adapt our CVP, including further developing our Pyaterochka Helps (Vyruchai-Karta) loyalty programme. In line with X5 Retail Group’s updated strategic priorities, we are already developing and preparing to pilot new omnichannel business ideas, while also actively seeking out new innovations that will help Pyaterochka develop its business and remain at the forefront of our sector as the next generation of food retail emerges.

Pyaterochka has reached a crossroads in its development, and the time has come to focus on strengthening the core business while also laying the foundations for new types of growth. In previous years, Pyaterochka focused on its record-setting pace of new store openings. We have already started to decelerate openings in order to focus more on smart expansion and improving investment returns. Going forward, Pyaterochka aims to find new sources of growth on the basis of our existing stores by further adapting its assortment to the changing needs of our customers.

In the years ahead we will continue to adapt our CVP, including further developing our Pyaterochka Helps (Vyruchai-Karta) loyalty programme. In line with X5 Retail Group’s updated strategic priorities, we are already developing and preparing to pilot new omnichannel business ideas, while also actively seeking out new innovations that will help Pyaterochka develop its business and remain at the forefront of our sector as the next generation of food retail emerges.

Pyaterochka is Russia’s largest proximity store network, and we have worked hard to make Pyaterochka the market leader, not only in terms of size but also in the minds of our customers. Just a few of our key achievements in recent years include the complete refurbishment of every store we operate, the launch of the only proximity store loyalty programme in Russia, the introduction of a new CVP aimed at a wider group of customers and the introduction of greater flexibility to adapt what our stores offer with assortments that include locally produced goods and the clusterisation of assortments based on the needs of certain types of customers in the area where a store is located.

The average Pyaterochka store has 391 square metres of selling space, with more than 4,500 stock-keeping units (SKUs) on offer.

2018 performance highlights

> 65 mln

as of 31 December 2018

48%

2018 strategic highlights

| 2018 | 2017 | 2016 | 2015 | 2014 | |

|---|---|---|---|---|---|

| Number of stores, eop | 13,522 | 11,225 | 8,363 | 6,265 | 4,789 |

| Selling space ’000 m2, eop | 5,291 | 4,427 | 3,329 | 2,423 | 1,754 |

| Net retail sales, RUB bln | 1,198 | 1,001 | 776 | 585 | 436 |

| Customer visits, mln | 3,913 | 3,267 | 2,543 | 1,990 | 1,645 |

Strategic Priorities

| Our priorities | What we are doing | What we plan to do |

|---|---|---|

| Smart expansion |

|

|

| Efficient loyalty and promo programmes |

| |

| Further adaptation of CVP and assortment |

| |

| Improve operational efficiency |

| |

| Strategic focus on customer satisfaction and employee engagement |

|

Customer-centric

approach to everything we do

Smart expansion and balanced growth

We dialled back the pace of expansion in 2018 to 865 thousand square metres, which is 21.2% less than in 2017. While this still represents significant growth, our focus going forward will be on ensuring quality and sustainability in order to strengthen the existing business. This will be achieved by adhering to the following principles:

- Focus on ROIC: Achieving target ROIC levels and maintaining profitability will be key criteria as we adapt our approach to new openings.

- Natural replacement of smaller players: While the previous years of expansion can be described as a “land grab”, the next stage of growth in Russian food retail will be defined by consolidation, and we aim for a significant portion of Pyaterochka’s growth to be through the acquisition of existing smaller players.

- Develop and leverage our geographic information system (GIS): GIS has been one of our core tools for selecting the right location for our new stores. In order to increase the quality of the system, we are constantly adding new data and algorithms to further enhance its accuracy.

- Focus on existing regions: In order to leverage existing logistics and transport infrastructure more efficiently, we aim to prioritise strengthening our presence in existing regions, while taking a more cautious approach to expanding into new markets.

Continued enhancements to CVP

We remain focused on adapting our CVP to evolving customer needs, with the goal of increasing the efficiency of our own operations. Some of the areas we are focused on include improving our client-centric assortment management process, using a clear assortment strategy and category roles. Since 2017, we have been piloting the clusterisation of stores, which will enable us to adapt the assortment at groups of stores based on demand in different types of locations.

Pyaterochka’s fresh category and private-label goods have also been central to our CVP, and we are focused on improving the quality of both. In the fruits and vegetables and ultra-fresh categories, we have achieved a 39% reduction in supply chain processing time, while also piloting new offerings such as fresh bread. Our private-label offering, which consists of 120 brands, accounted for 12% of Pyaterochka’s 2018 net retail sales.

Private-label quality has been supported by the formation of a dedicated private-label team, as well as increasing analysis of customer feedback and customer needs to develop new products.

One of the core elements of Pyaterochka’s CVP is price perception, and we are improving pricing processes with automated systems, cluster-based pricing and the implementation of pricing policy tools.

We believe that promo activities represent an area for potential improvements in both our CVP and operational efficiency. To achieve this, we are rolling out promo efficiency solutions and piloting a new system that enables us to more accurately measure promo performance across our stores.

Loyalty programme

Loyalty programme – a key to growth

Pyaterochka’s loyalty programme, Pyaterochka Helps (Vyruchai-Karta), has delivered impressive results to date, and we view it as a key to potential future growth. Pyaterochka is the only proximity store format in Russia to offer customers a loyalty programme, and we are committed to further enhancing the programme to make it even more attractive.

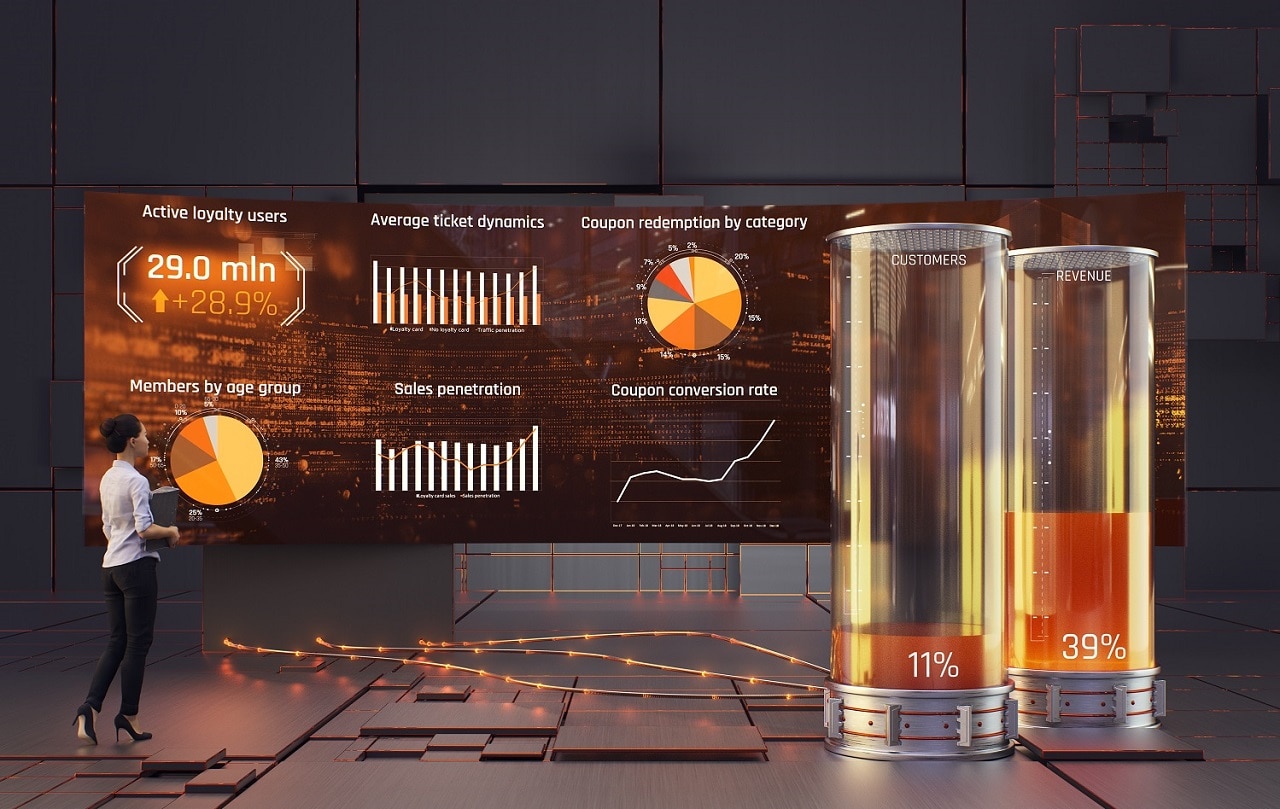

Penetration of the loyalty programme in traffic reached 48% in 2018, up from 42% a year earlier.

We had 29 million active programme members as of 31 December 2018, and our Pyaterochka Helps card holders accounted for 64% of sales for the year. These customers are key contributors to our business: 11% of our high-value customers with loyalty cards account for 39% of revenue.

Operational efficiency

Ongoing improvements to our operational efficiency is an important cornerstone of our strategy. One of our key areas of focus in 2018 was reducing shrinkage: in the second half of 2018, thanks to measures introduced by the new team at Pyaterochka, we managed to cut shrinkage by several dozen basis points.

Another priority area is the continued development of our efficient, multilayer logistics infrastructure, which will help us to keep operating costs to a minimum while supporting our growing federal network of proximity stores.

Pyaterochka has also launched a lean store initiative to help further improve efficiency. This initiative involves gathering insights into how operations can be optimised in order to improve processes, product quality and labour efficiency. We aim to develop a set of recommendations and policies that will enable us to implement key learnings from this process across our stores.

In addition to these measures, Pyaterochka has continued to reduce rent costs by renegotiating rental contracts with a focus on rental rates being variable as a percentage of revenue. These renegotiated contracts accounted for 38% of Pyaterochka’s selling space at the end of 2018.

Omnichannel business and innovations

Pyaterochka, like all of our formats, aims to develop its own omnichannel retail business lines. One area where Pyaterochka, together with all of X5 Retail Group’s formats, has already begun to implement this strategic priority is the installation of parcel lockers. By installing these lockers, we are providing customers a convenient way to pick up orders from third-party online retailers when they visit one of our stores.

The rollout of these lockers is expected to bring incremental increases in traffic to our stores. By the end of 2018, 1,599 such lockers had been installed in 1,531 Pyaterochka stores. We are constantly reviewing new ideas, and additional omnichannel business lines are due to be introduced at our Pyaterochka stores in 2019 and beyond.

Our focus on innovations also led Pyaterochka to become the first X5 format to open a lab store. We use this store to test innovative technologies and ideas in a real store operating environment. This enables us to gain a better understanding of how potential new technologies or processes could impact on operations. The lab store is currently testing a range of new technologies, including video analytics to automate monitoring queues at tills and shelf availability.

Human resources and recruitment

Pyaterochka is a major employer in Russia with over 176,000 people working across all of the format’s operations (excl. outstaffing). This includes the X5 head office, as well as stores and logistics. One of the most important challenges that we deal with when opening a new store is finding the right people to hire. This can sometimes be significantly more challenging than the process of selecting a location and preparing the store for opening.

In order to address this challenge, and to encourage all of our employees to focus on customer needs, Pyaterochka is introducing new values and incentive schemes to further enhance customer-centricity. We believe that this is a key element of putting our customers at the centre of everything we do, in addition to initiatives like updating the CVP, adapting assortment and implementing loyalty programmes.

The new organisational structure that we have put in place at Pyaterochka will help us to implement a culture of continuous improvement based on analysis of customer feedback. Among other things, we have introduced NPS performance as an element of the motivation schemes for in-store personnel, including for store directors.